Getting My Clark Wealth Partners To Work

Wiki Article

Not known Facts About Clark Wealth Partners

Table of ContentsTop Guidelines Of Clark Wealth Partners4 Easy Facts About Clark Wealth Partners DescribedSome Known Incorrect Statements About Clark Wealth Partners Clark Wealth Partners Can Be Fun For Anyone8 Simple Techniques For Clark Wealth PartnersThe 8-Minute Rule for Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get ThisThe Definitive Guide to Clark Wealth Partners

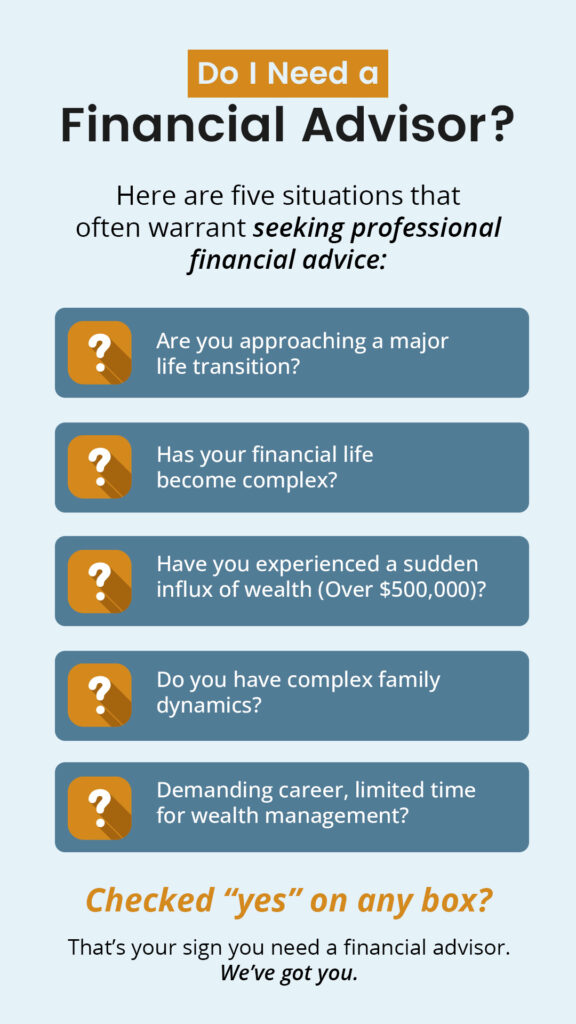

Typical factors to think about a financial advisor are: If your financial scenario has ended up being more intricate, or you do not have confidence in your money-managing abilities. Conserving or browsing major life occasions like marital relationship, separation, youngsters, inheritance, or work change that may considerably influence your economic situation. Browsing the shift from conserving for retirement to preserving wide range throughout retirement and how to develop a solid retirement income strategy.New modern technology has actually led to more detailed automated financial tools, like robo-advisors. It's up to you to check out and establish the appropriate fit - https://www.huntingnet.com/forum/members/clrkwlthprtnr.html. Inevitably, an excellent financial advisor should be as mindful of your investments as they are with their very own, staying clear of excessive charges, saving money on tax obligations, and being as clear as feasible about your gains and losses

Getting The Clark Wealth Partners To Work

Gaining a compensation on item suggestions does not necessarily indicate your fee-based advisor antagonizes your finest rate of interests. They may be a lot more likely to advise products and services on which they gain a payment, which may or might not be in your finest passion. A fiduciary is legitimately bound to place their client's interests initially.This standard enables them to make suggestions for financial investments and solutions as long as they suit their customer's objectives, threat resistance, and financial scenario. On the various other hand, fiduciary advisors are lawfully obliged to act in their client's ideal interest instead than their own.

About Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving into intricate economic subjects, clarifying lesser-known financial investment avenues, and discovering ways viewers can function the system to their benefit. As an individual finance professional in her 20s, Tessa is really conscious of the effects time and unpredictability have on your financial investment choices.

It was a targeted promotion, and it worked. Find out more Review less.

Not known Facts About Clark Wealth Partners

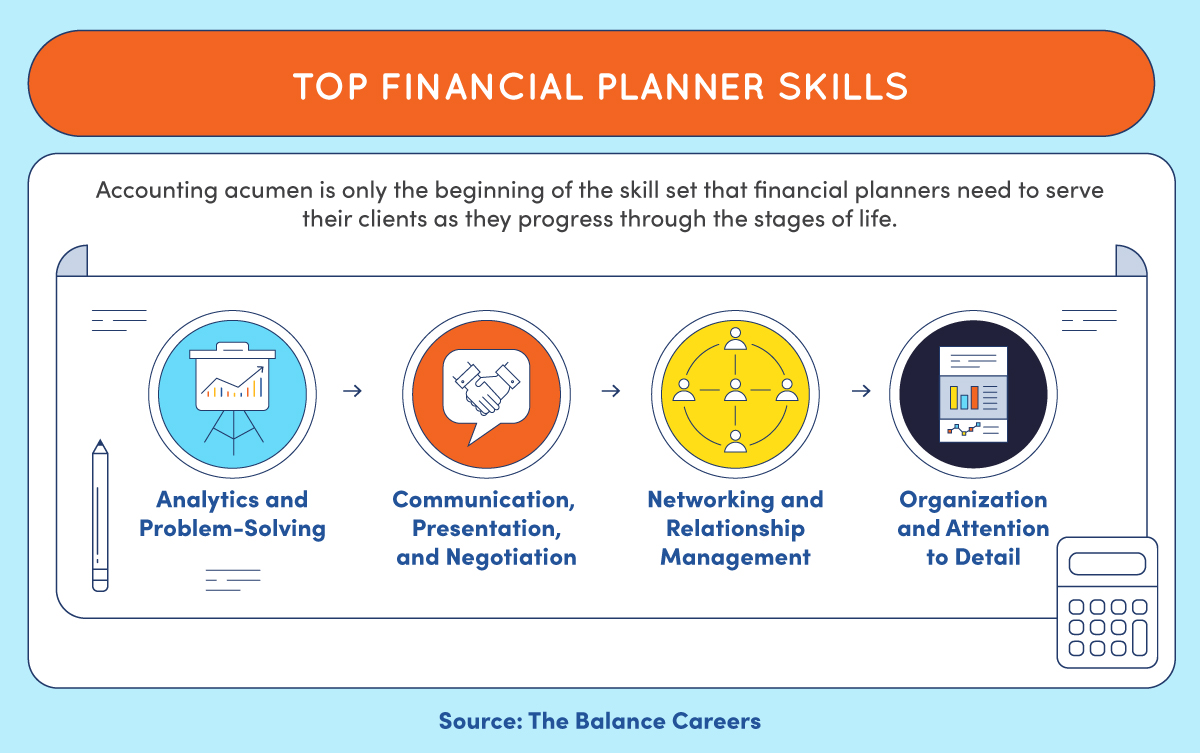

There's no solitary route to turning into one, with some people beginning in financial or insurance, while others start in audit. 1Most monetary coordinators begin with a bachelor's level in money, business economics, accounting, company, or a relevant topic. A four-year level gives a solid foundation for professions in investments, budgeting, and customer service.

7 Easy Facts About Clark Wealth Partners Described

Usual examples include the FINRA Collection 7 and Series 65 exams for protections, or a state-issued insurance coverage certificate for marketing life or health and wellness insurance policy. While credentials might not be lawfully required for all preparing functions, companies and clients commonly view them as a criteria of professionalism and trust. We consider optional credentials in the following area.A lot of monetary planners have 1-3 years of experience and familiarity with monetary items, conformity requirements, and direct customer interaction. A strong instructional history is crucial, but experience demonstrates the capability to use theory in real-world setups. Some programs incorporate both, allowing you to complete coursework while gaining supervised hours with internships and practicums.

Facts About Clark Wealth Partners Uncovered

Early years can bring lengthy hours, stress to develop a customer base, and the demand to consistently show your proficiency. Financial coordinators enjoy the possibility to function closely with customers, overview crucial life choices, and commonly achieve versatility in routines or self-employment.

Wide range supervisors can raise their profits with payments, possession costs, and performance incentives. Monetary supervisors supervise a team of financial coordinators and consultants, establishing departmental strategy, taking care of compliance, budgeting, and directing inner procedures. They spent much less time on the client-facing side of the sector. Virtually all economic supervisors hold a bachelor's level, and many have an MBA or similar graduate degree.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Optional qualifications, such as the CFP, generally require additional coursework and screening, which can expand the timeline by a number of years. According to the Bureau of Labor Statistics, individual financial experts earn a typical annual yearly salary of $102,140, with leading earners gaining over $239,000.In various other districts, there are laws that require them to satisfy specific needs to make use of the financial advisor or monetary coordinator titles. For monetary planners, there are 3 typical designations: Qualified, Individual and Registered Financial Coordinator.

The Single Strategy To Use For Clark Wealth Partners

Those on salary may have a motivation to promote the product or services their employers use. Where to discover an financial advisors Ofallon illinois economic consultant will certainly depend on the kind of suggestions you require. These organizations have staff who might help you understand and acquire particular kinds of financial investments. As an example, term down payments, ensured financial investment certificates (GICs) and mutual funds.Report this wiki page